As a photographer or any self-employed business owner, you are responsible for paying taxes on your net profit, which is the amount left over after deducting your business expenses from your gross billings. And now is the time to make your Estimated Tax payment.

For those who do not own a business, it might be surprising to see how much expenses can take out of a business’s income. These expenses can add up quickly, from camera equipment to marketing costs, leaving a small net profit for the business owner.

To determine your net profit, you must keep track of all your business expenses throughout the year, including camera gear, studio rental fees, travel expenses, and insurance costs. Then, subtract these expenses from your total gross billings, and you will have your net profit, the amount you must pay taxes on.

For example, if a photographer made $50,000 in gross billings but spent $10,000 on expenses throughout the year, their net profit would be $40,000. This is the amount they would pay taxes on for the IRS, their state, and sometimes their county or city. My average amount of expenses as compared to gross income, is about 52%.

Making Estimated Tax payments throughout the year helps you avoid a hefty tax bill at the end of the year and prevents any penalties from the IRS for not paying enough taxes.

For employees who do not own a business, it may be shocking to see how much expenses can take out of a business’s income. This is a great reminder to appreciate the benefits of being an employee, including having certain costs covered by the company and receiving other employee benefits.

Now is the time for photographers and other self-employed business owners to make their Estimated Tax payments. By keeping track of your expenses throughout the year and subtracting them from your gross billings, you can determine your net profit and ensure you pay the appropriate tax amount.

Here are some tools I use to help with tracking income & expenses:

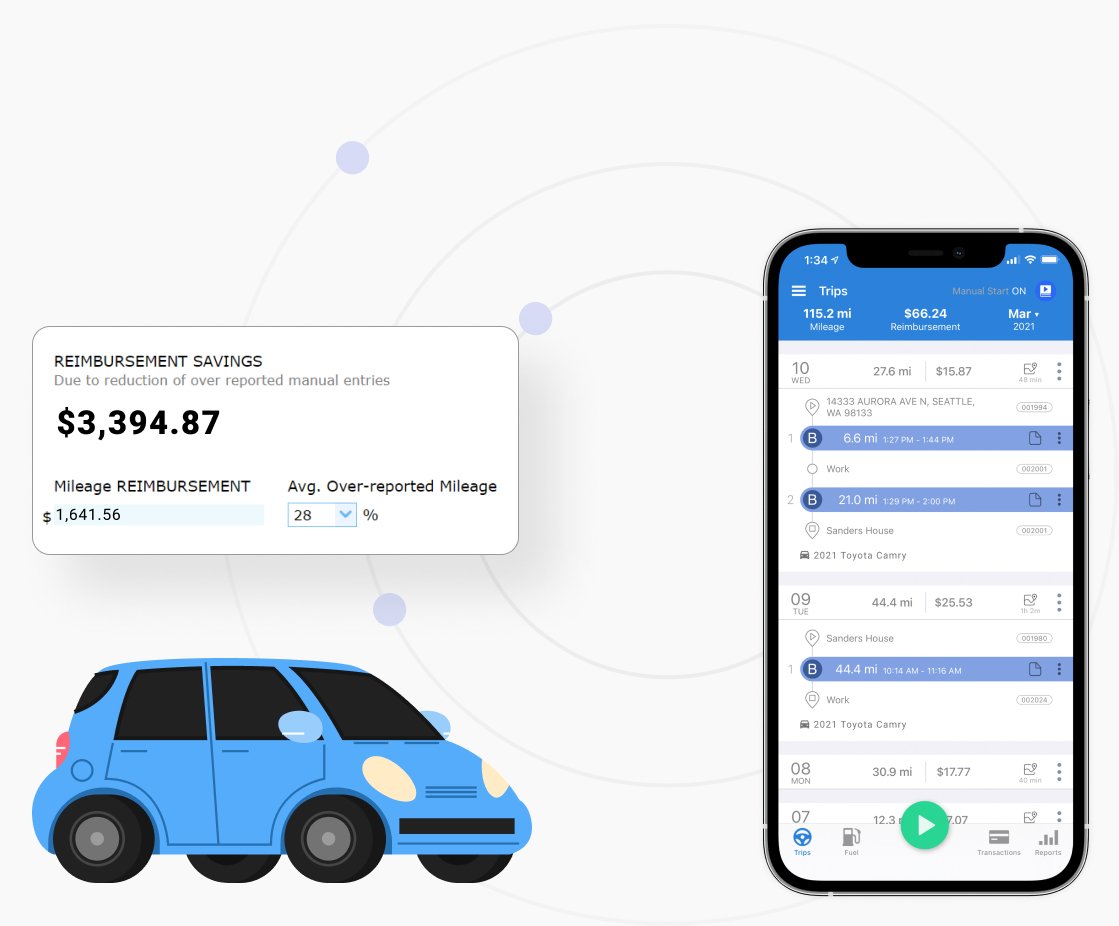

In addition to keeping track of expenses, tracking mileage can significantly impact your business’s taxes. For example, you may frequently travel for shoots, meetings, or other business-related activities as a photographer. This is where TripLog comes in handy. TripLog is a mileage-tracking app that allows you to record your mileage automatically or manually. Using TripLog, you can accurately track your mileage and ensure that you deduct all of your business-related travel expenses on your tax return.

Another helpful software that I use as a photographer is FotoBiz. It is a comprehensive tool that allows me to create professional-looking estimates and invoices and helps me track payments and manage client information. With FotoBiz, I can easily customize my estimates and invoices, add my logo, and include all the necessary details like pricing, services, and terms and conditions. Additionally, FotoBiz offers features like tracking job expenses, managing contacts, and generating reports, making it a powerful tool for managing my photography business. Using software like FotoBiz helps me save time and streamline my workflow, so I can focus more on creating beautiful images for my clients.

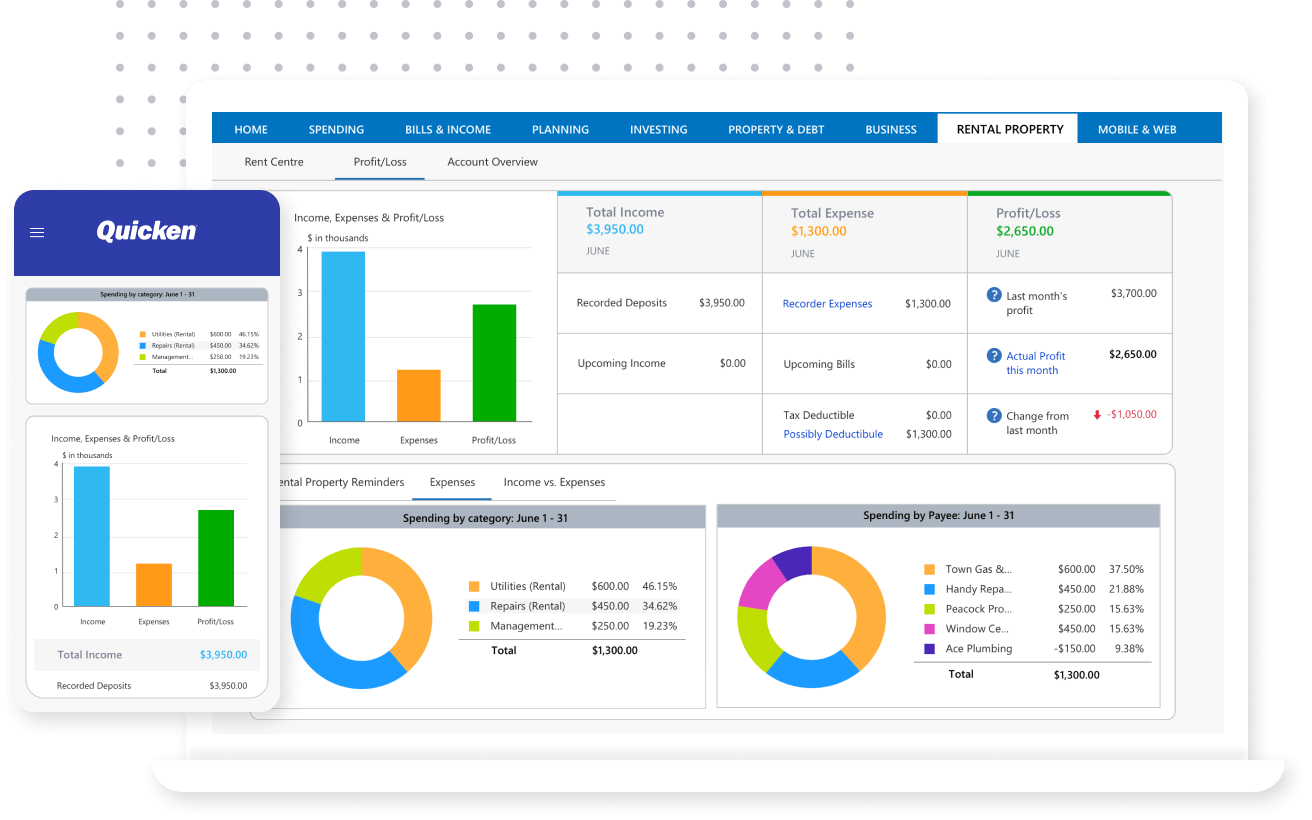

Another helpful tool for tracking expenses is Quicken for Mac. Quicken allows you to easily track your income and expenses and categorize them according to the Schedule C form you’ll use when filing taxes. This makes it easy to see which costs can be deducted and ensure you’re not missing any tax write-offs. Quicken also offers various reports to help you analyze your business’s financial health and make informed decisions.

When storing receipts, I use a scanner app on my phone to scan receipts and attach them to the corresponding transaction in Quicken. This helps me keep track of my expenses and ensures a record of each transaction. This can also be useful if the IRS audits you and must provide documentation for your expenses.

In conclusion, tracking expenses and mileage is crucial for any self-employed business owner, including photographers. By using tools like TripLog and Quicken for Mac and scanning receipts, you can keep track of your expenses and ensure that you’re accurately deducting all of your business-related expenses on your tax return.