Disclaimer: I am not getting any money from TripLog and I am not affiliated with them at all.

So you need to get the most out of the tax deduction by tracking your mileage. The IRS lets you deduct some of the costs of using a personal vehicle for business purposes. Like you can remove the cost of business expenses such as marketing, you can also deduct your business mileage.

58 cents

Beginning January 1, 2019, the standard mileage rates for using a car (vans, pickups, or panel trucks) will be 58 cents per mile for business miles driven, up from 54.5 cents in 2018. Twenty cents per mile driven for medical or moving purposes, up from 18 cents for 2018. [update 62.5 cents starting July 1, 2022]

Commuting from your home to your regular workplace and back is not deductible every day. You may deduct business mileage only if you travel to and from a temporary work location, from one work location to another, to meet with a client, to a conference, etc.

Yes, you can deduct the mileage. As an independent contractor (received a 1099-MISC), you are considered self-employed by the IRS. … You can remove the miles driven for business. The other option is claiming all your expenses such as gas, tires, interest, etc.

I live in the Metro-Atlanta area, and on average, the round trip to a job is about 40 to 100 miles. That means I write off my taxes from $23.20 to $58.

You can use a notepad and write down all your mileage, fill-ups, repairs, and auto expenses and then spend some time adding things into those categories that you want to use for deductions at the end of the year on your taxes.

I have found after doing this for more than 35 years that having an APP is so much easier.

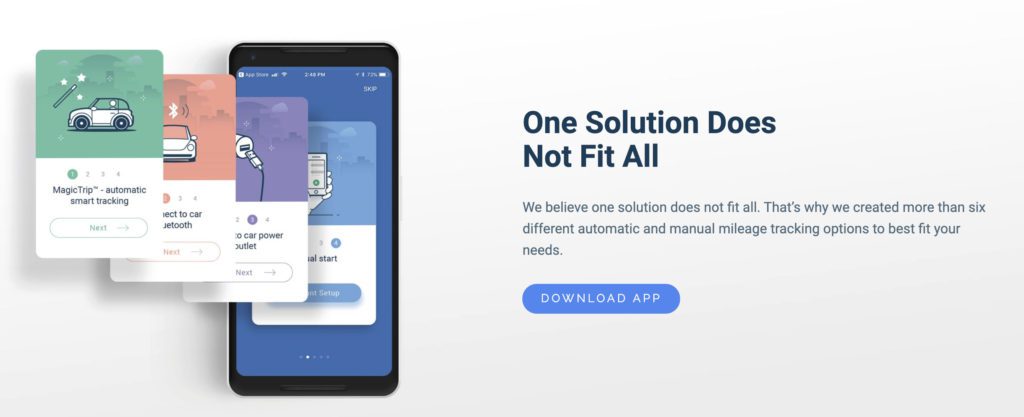

I like that this app can be customized. TripLog has three auto-start options and also a manual start for each trip.

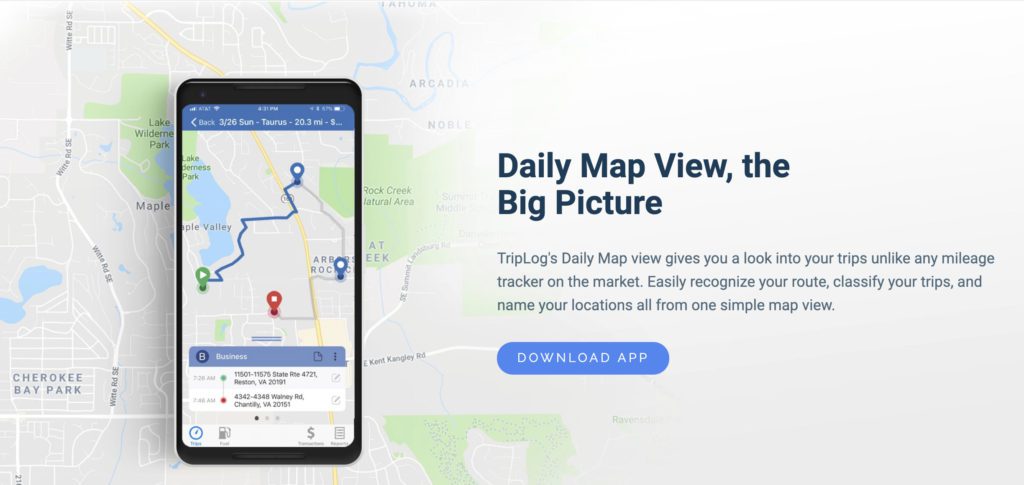

You can use your phone’s GPS with the app to track your trips.

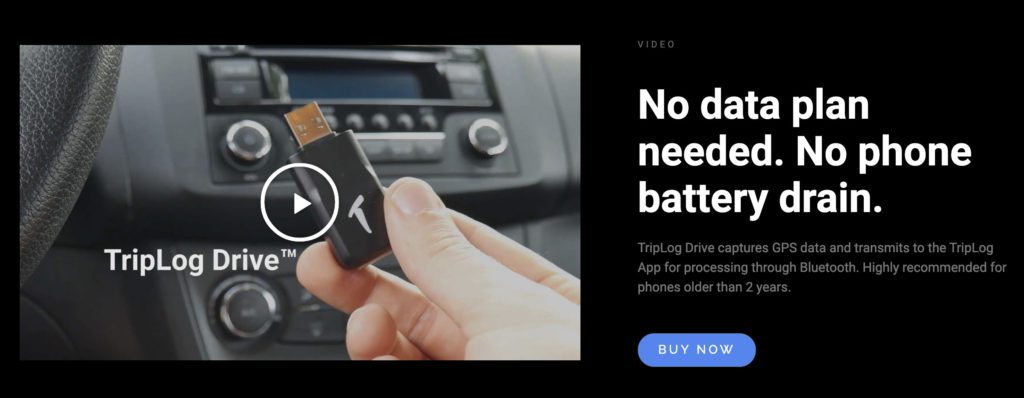

They even created a device you plug into the car’s USB, which will pair with the phone so that you are not using data to track your trips.

Here is the video of how that works:

I use my one account on both of our vehicles. My wife tracks her mileage with her Toyota Camry, and I follow the Toyota Sienna.

Keeping a mileage log

The IRS tends to be strict in its documentation requirements for business mileage deductions. For this reason, you’ll need to keep a thorough, accurate mileage log each year you attempt to claim a deduction.

Your mileage log must include the starting mileage on your vehicle’s odometer at the beginning of the year and its ending mileage after the year. Each time you use your car for business purposes, you must record the following information:

- The date of your trip

- Your starting point

- Your destination

- The purpose of your trip

- Your vehicle’s starting mileage

- Your vehicle’s ending mileage

- Tolls or other trip-related costs

You can keep a mileage log in a notebook and update it by hand or use a spreadsheet to track your mileage continuously. You can also use a mileage-tracking app. The key is to update your records regularly to ensure they’re precise. Additionally, the IRS requires you to keep your mileage log for three years from the date you file the income tax return containing your deduction.

I recommend using an App to help you capture the data you need for reporting purposes.