The past few days have been a bit of a reality check, and if you’re freelancing or running your own business, you might relate.

I’ve been knee-deep catching up on bookkeeping. It’s the kind of task that’s easy to push aside when you’re focused on client work, editing projects, or traveling for assignments. But when you let it go too long, it’ll take a few solid days to get everything back in order. That’s precisely what I’ve been doing lately.

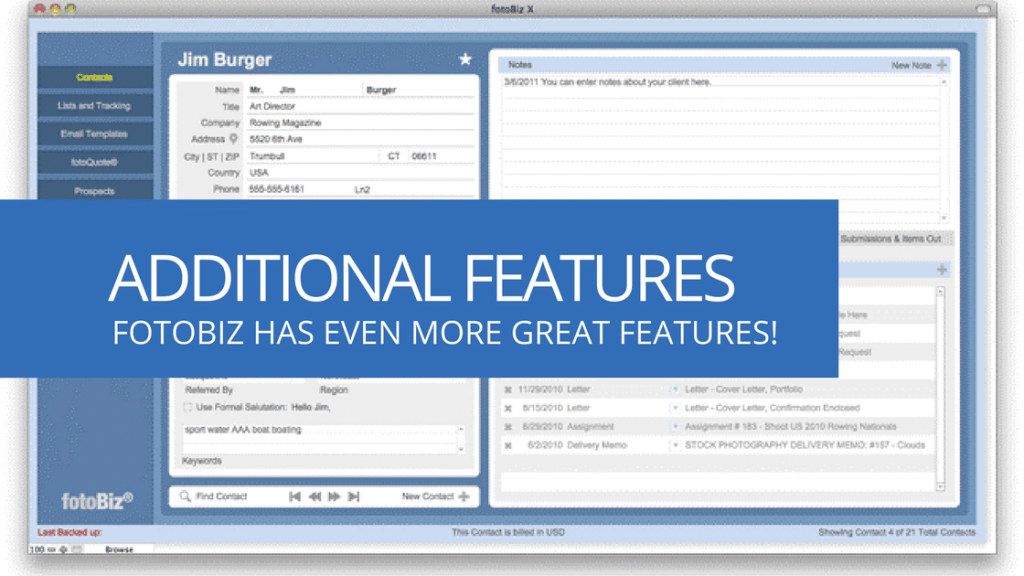

For my system, I use Quicken to help manage my books and FotoBiz to create and track invoices. Every American Express and bank account transaction must be appropriately categorized for tax purposes. It’s tedious but necessary.

And here’s one extra step: I scan every tax-related receipt, turn it into a PDF, and attach it directly to the transaction in Quicken. Why? Because if you’re ever audited—and I have been, three times—you’ll be incredibly thankful you kept a paper trail organized and ready to go.

Now here’s something I wish more folks talked about when starting their freelance journey:

Running your business takes time that doesn’t always appear on a client invoice.

According to the U.S. Small Business Administration and several time-tracking studies, solo business owners typically spend between 15% and 25% of their time on administrative tasks, such as bookkeeping, invoicing, categorizing expenses, and tax preparation. That’s 6 to 10 hours per week if you work a 40-hour.

If you’re starting, it’s easy to overlook this side of the work. But it’s just as important as delivering great client results.

My advice?

Set aside regular time—weekly if possible—to handle your books. It’s a lot easier to stay organized than to go back and clean up a mess. Trust me.

If you have questions about how I organize things or what I’ve learned from those audits, I’m happy to share. After all, part of my mission as a storyteller is helping others build strong foundations for the work they’re called to do.