Bookkeeping??? I want to shoot.

If you don’t like keeping track of your spending or budgeting and can never see yourself doing this, then read no further.

However, if you want to make money with your camera and do this as a profession, you have no choice but to keep track of all your expenses and income, or you can go to jail for tax problems. It is just that simple.

Even if you hire an accountant, you must keep records to give to them.

This blog post is for those who hate taxes and are interested in a simple way to do it.

The IRS needs to know where all your income is coming in from and what are all your expenses. By the way, you need documentation to back this up in receipts and record keeping.

Here is what I do for my record keeping for the IRS.

These are some tips I have to offer for photographers to help with taxes.

First, a disclaimer: I am not an accountant or lawyer, so please check anything I say with a Certified Public Accountant.

I recommend using Quicken Home & Business. Here is a link. [UPDATE 9-2-22] I am using Quicken for Mac to keep track of expenses and FotoBiz for Invoicing. Link to blog on FotoBiz

Why do I use Quicken Home & Business?

When I got my first computer, it came with Quicken, and I just started using this back in the 1980s.

I liked a few basic features, which for the most part, are the same as the first version I ever used.

The template looks just like your check register. You have a box for Payee, the amount, and, most importantly, the category.

Categories

Quicken helps you set up categories based on IRS Schedule C for your business. Out of the box, you can select the default and be pretty close to being done. I suggest paying a CPA to consult on the categories you need to use for your business.

Now there are a few cool things that Quicken can help automate your bookkeeping. One of the best things is that many credit card companies make it so Quicken can talk to them and download all your transactions. So the only thing you will need to do is to be sure you are assigning the correct category to each transaction. But after the first time with a vendor, it goes to your last category the next time it comes up.

Using multiple categories for a vendor will let you choose which one from a pull-down menu.

Receipts

You can attach a receipt to any transaction. Receipts are essential for bookkeeping.

You may also be wondering about what the IRS thinks about digital receipts. The short answer is that digital receipts are as acceptable as paper copies. According to Rev. Proc. 97-22, the IRS allows taxpayers to save electronic images of documents and destroy the original hard copy.

You are meeting the IRS requirements if you scan your receipts and attach them to the transaction.

You can see here a scan of a cash receipt. I put this in my Cash Transactions.

Vehicles

Quicken even comes with Vehicle Mileage tracking.

Tips for tracking your mileage.

You will need the odometer reading for the beginning and end of each year. So, on New Year’s Eve or Day, you must write down the odometer reading.

Think of tracking your mileage like you would do a checkbook transaction. It would help if you wrote where you went for business. You need the starting odometer reading and the end reading. You can track your tolls in the same place and your parking if you like. I choose to track all my receipts for tolls and parking in either my credit card or cash account.

The IRS will want your actual business, personal, and overall mileage for the tax year.

Also, keep track of actual vehicle expenses. You can deduct whichever you want–mileage or actual expenses.

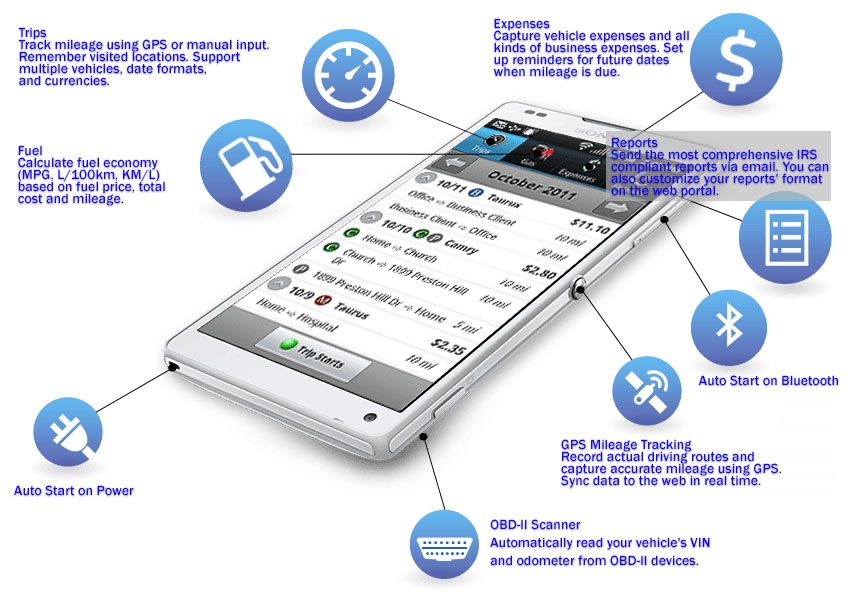

TripLog is a fantastic and easy way to track your mileage if you have a smartphone. I recommend you check out TripLog for use with your Android Device or iPhone.

TipLog Highlights

- The most popular GPS mileage tracking app with over 300,000 downloads

- The only app that AUTO STARTS when connected to power or Bluetooth devices

- The only mileage tracking app that reads a vehicle’s odometer from OBD-II devices

- Sync and merge data to TripLog Web from multiple devices with Fleet Management

- The most comprehensive reports compliant with IRS TAX returns

Since I am tracking all my personal and business expenses, I can easily see my actual costs for a vehicle in a given year. The note field is where you specify which car was at the shop. So you can use actual expenses or mileage for the IRS forms. The good thing is that TripLog and Quicken Home & Business help you decide the best to use in any given year.

Invoicing

I like the ability to use your logo and customize your invoices with Quicken.

To get paid, I must invoice clients for the work I did for them. I have set up a few categories of billables that I use for invoicing.

You can have, for example, an unlimited number of ways to charge for your services. Once created, it will automatically drop all the explanations you use to describe what you did for them.

If you have taxable items that you invoice for, then you can set up those categories to automatically tax at the rates for your area.

It is pretty common to have some billables that are taxable and others that are not. But, again, this reminds you why you need to talk to a CPA to get your setup.

Another cool thing with the software is you can put in the due date for invoices, and Quicken will help you avoid late paying. Knowing late payments is critical when you are short on cash due to slow payment.

April 15th

If you have used Quicken Home & Business throughout the year to track all your expenses and income, then TurboTax Home & Business can import all this data. Then basically, you click through questions to verify that it is correct.

Filing my taxes has never been easier.