You need to understand what you need for each category over a year.

Knowing the costs of doing business is step two of learning how to quote a price to someone when they ask you, “How much do you charge?”

In step one, you should have devised an annual figure for your living expenses in step one. For example, if you live in a gated community and drive a premium vehicle, you can see that what you have to charge to pay your bills will impact your prices for your clients.

The other extreme I often encounter when teaching folks how to figure their prices is if they are in college or live at home. If they use their actual expenses for their annual salary, they will have to live with Mommy and Daddy for the rest of their lives. If you are one of these folks, then take some time and research what it would cost you to be alone. A few things will significantly change for those under 25 if they are alone and not with their parents.

- Housing costs

- Car Insurance

- Health Insurance

These three items will be much more expensive if you do this alone.

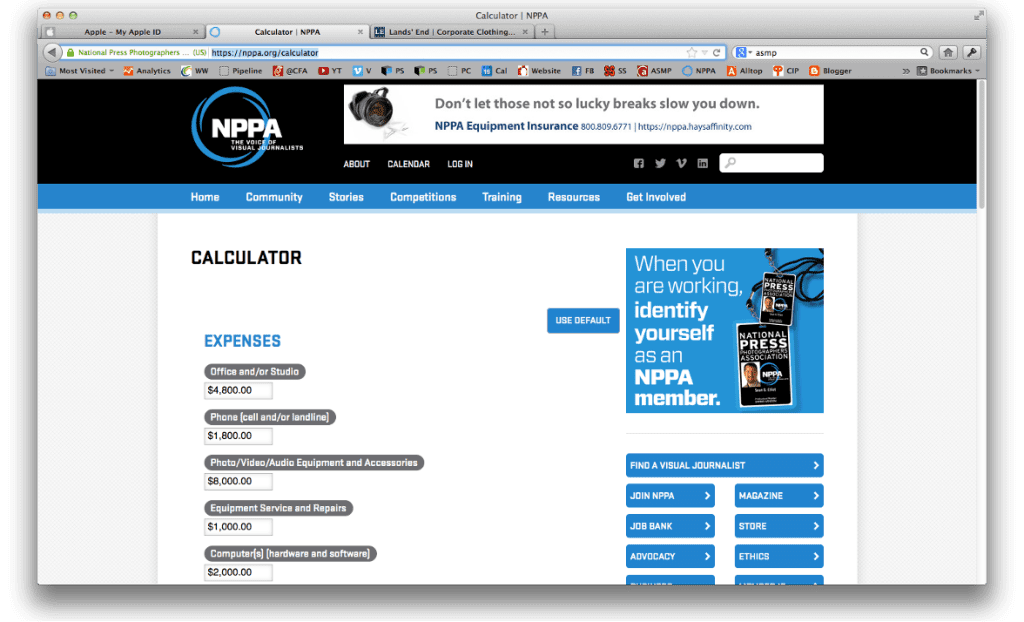

I suggest going to the NPPA website and plugging in your figures. However, there is a better reason to go to the website than just using it as a calculator. Beside each item, there is an i-button. You have to be a member these days to access this calculator.

- Telephone

- Utilities

- Internet Connection

- Auto expenses

- Computer

Adjust your home budget.

You will need to revisit your “Annual Salary” and most likely realize you can now take home less for your home budget because some of this shifted to your “Business Expenses.” Revisiting your budget items will slightly affect the rates that you must charge.

A little guessing

Determining the average job or assignment you will do with your business would be best. I found this difficult, but you can change this later if needed. It is the most challenging thing to approximate for several reasons. For example, I might do some photo shoots in a year.

- Headshots

- College Recruiting

- Corporate events

- NGO editorial coverage

- Magazine features

- News coverage for wire service

The prices for each of these are different for various reasons. First, they don’t all take the same amount of time. But, more importantly, I am an expert in some of these, and my competitors cannot compete head-to-head with me with all my clients.

The basic idea is that once you have figured out how many of these assignments you will do a year, you will guess what an average job entails. Next, take the same list and indicate how many you will do in a year. Besides that, how long does it take you, on average, to complete the work?

- Headshots (100) x [2 hours] = 200

- College recruiting (15) x [20 hours] = 300

- Corporate events (12) x [20 hours] = 240

- NGO editorial coverage (10) x [30 hours] = 300

- Magazine features (15) x [8 hours] = 120

- News coverage for wire service (20) x [3 hours] = 60

Total “billable” hours a year of 1220 divided by 8 hours a day gives you 152.5 days of “billable” time.

Now, this is a figure when you are starting maybe 30 days that you can find work in a year.

RED ALERT!!!

You will need to assume that you either 1) have saved enough money to offset your lack of jobs until you get enough jobs or 2) have another job.

A successful photographer will likely have around 100 “billable days” of work in a year.

Using the 152.5 days of work a year will give you a $ 589.18-day rate if you use the default numbers in the NPPA calculator–DON’T DO THIS–use your numbers. For illustration, this would give you a $73.65 per “AVERAGE” hour rate that you “MUST” charge at the minimum, or your business model will be upside down.

I say average because, on some jobs, you can charge more since you might have little or no competition or the going rates in the market allow for a higher rate.

Don’t Quote Hourly Rates

This exercise is to help you know your costs, not to give you the rate to quote.

Combine it all

Now that you know your “Cost of doing business,” you will combine this with actual expenses associated with a job. Here are some of those expenses you will add to your base:

- Travel Expenses

- Prints/CDs/Online Fees

- Shipping Costs

- Photo assistants

- Makeup artists

- Food costs (snacks for day-long shoots, for example)

These expenses are not an exhaustive list, but this will go on top of your $589.18 if it is a day-long shoot.

Usage Fees

I discussed how to calculate these earlier, and this will go on top of the $589.18 plus expenses that will give you some idea of what to quote.

Trade-outs

While you have everything to quote a job and are ready, some things are negotiable. For example, if a client gives you 50 copies of the coffee table book you did for their organization, you could trade this out for a lower price because you can now offset some advertising costs. You can then give these books to potential customers, helping you land a new client.

I know some photographers who trade out the retail value of their services, say with a restaurant. They give them $2,000 worth of photography for $2,000 worth of food. It is a win-win because the business costs maybe $1,000 for the photographer and only $1,000 for the restaurant. The photographer takes potential clients out for dinner at the fine dining restaurant, and it helps them seal the deal. The photographer just saved $1,000 in expenses for overhead.

Summary

If you know these figures, you will feel confident that you can pay your bills doing the job when quoting prices. You also will feel that you did the right thing when they offer you less than your rates for a job and you turn them down. Finally, once you have the numbers, you can still be creative to develop solutions that make you the right fit for a job.