This year I got a letter from the IRS requesting documents. This is an Audit.

Every year when I file my taxes, I use TurboTax.

For the past 10+ years, I have paid little for their accounting service that helps you in the case of an audit. While working with them to get all my documents for the IRS, I learned a few things that I think you need to know.

Three Documents for Expenses

I learned through this process that there are three things you need to document and have ready like a bookkeeper.

- Invoice – Need to show what you were billed for from the provider

- Payment – Need to show that it was paid

- You Paid It – Besides showing it was paid, you must show that you paid it and not someone on your behalf.

I am using Quicken for Mac to track all my expenses. Here are a few of the ways I pay bills:

- Check – Checking Account

- Visa Debit Card – Checking Account

- MasterCard

- American Express Card

- PayPal

I am paid two ways

- Checks

- PayPal

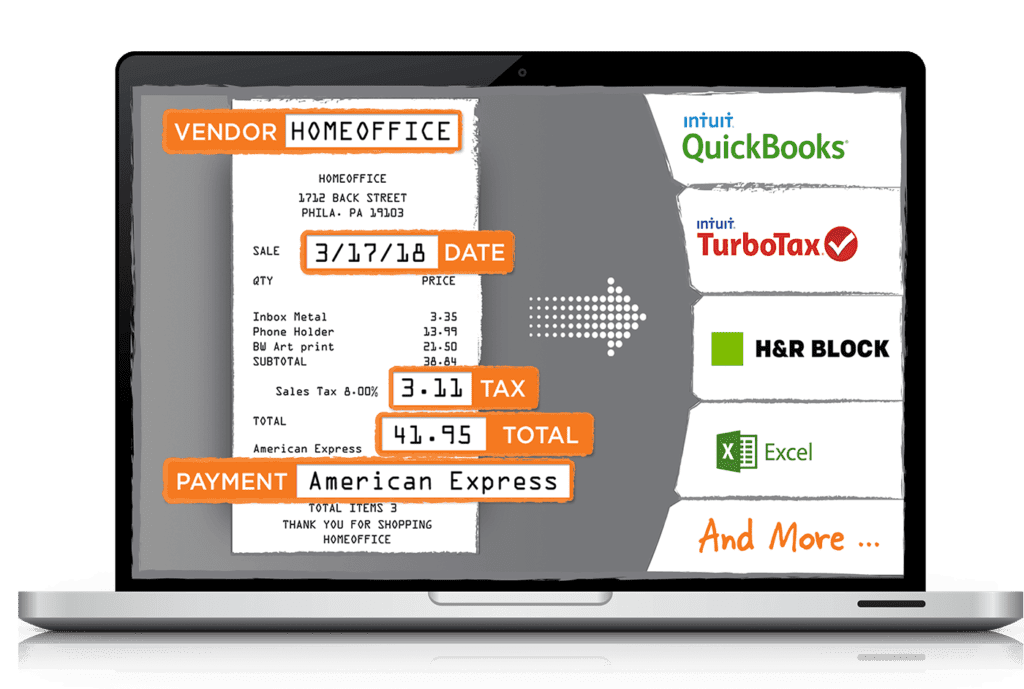

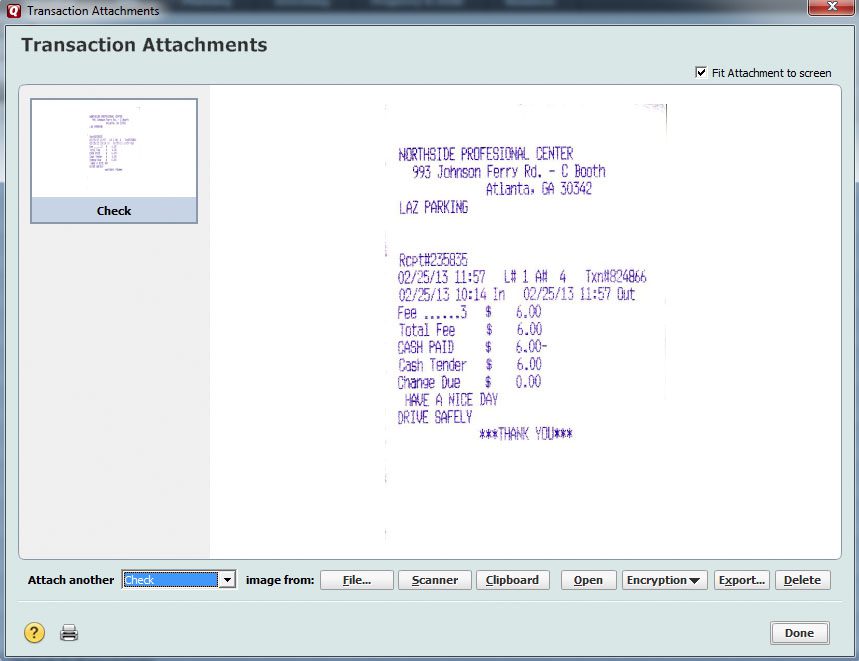

In the software Quicken, you can attach to every entry document. Before I can attach those receipts, invoices, and statements, I must have a digital file like a PDF or a picture. I bought a Neat Desk Scanner years ago and have been using their software, which is now an online system.

The Neat Desk scanner lets me scan a stack of receipts making things go much faster than a flatbed scanner.

After scanning documents, I save them in a separate folder for the year they were created. Then I attach them in Quicken to the transaction.

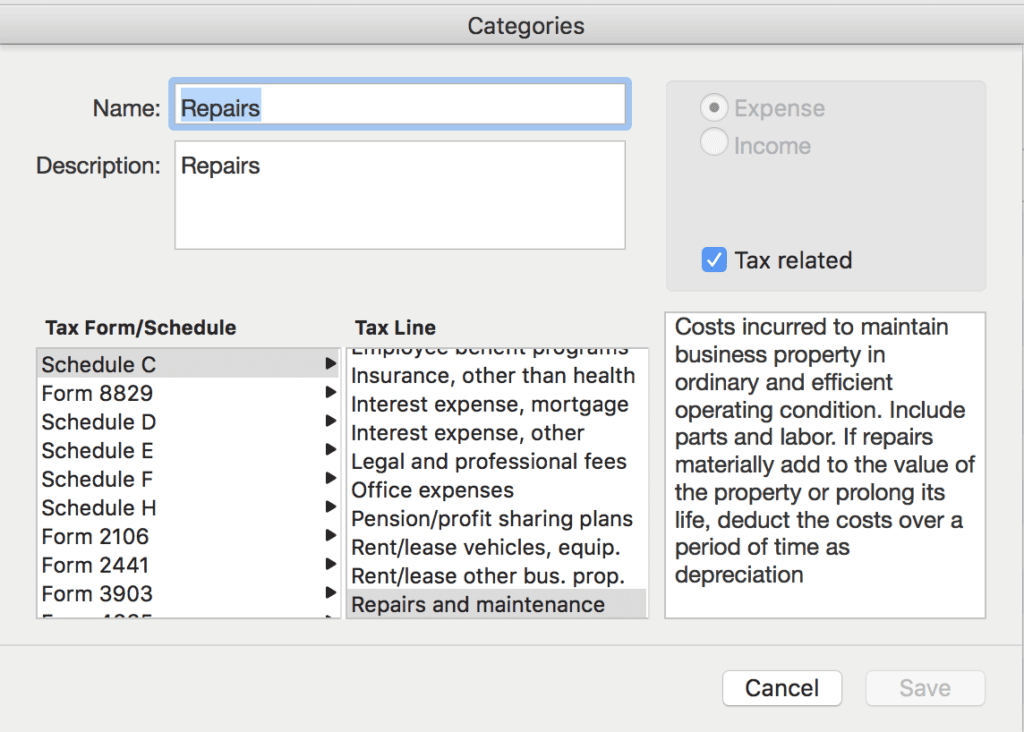

In Quicken, they have categories all ready for you to use and customize. The best part about working with your Taxes is they have all the Schedules included so that you can assign a category to a tax schedule, as I have in this example with the Camera Repairs in Schedule C: Repairs and maintenance.

The Headache

While I have all my documents, I quickly realized the problem was getting precisely what the IRS needed in a format that met their requirements was the biggest problem.

I had to go through my AMEX & Bank statements and circle every item related to a particular category showing that this was paid with my money.

You can also do this with a scanned receipt of every transaction.

It was easier for me to contact all the Doctors, Hospitals, and medical providers and ask for a 2016 statement for all charges than to provide scanned invoices. I was missing a few of the statements because I thought I just needed to show I paid the bill and not the invoice.

Using Quicken, I created a spreadsheet of each category and payee for a particular topic that I was being asked to provide evidence to the IRS. I was mainly dealing with medical expenses due to a costly year for our family with medical issues.

I was misinformed

I had always been told you need to put all your receipts in a box and if ever audited, just show up, and they can go through them if they want. WRONG!!!

My accountant informed me that the IRS, on numerous accounts with her, have said they are not their client’s bookkeeper. It would help if you had this in order. Also, the box could only work when you are called in. You don’t want this to happen. You have opportunities to provide all this electronically to the IRS and handle it without going for a face-to-face audit.

Tips

- Spreadsheet – Be able to provide the spreadsheet for any category, which Quicken helps with this

- Invoices & Statements – Scan all these or have them ready to scan if audited.

- Receipts – Scan all these or have them ready to scan if audited.

- Bank & Credit Card Statements – Keep them if you need to scan them for the IRS during an audit.

- Scanner – I recommend a scanner that is a sheet feed scanner capable of scanning multiple documents and software to help organize your records.

- Accountant – Work with an accountant to do at least your initial setup of how you need to gather documents for Taxes and possible audits.

Tips on Invoicing

I wrote a blog early called “7 Tips for the financially struggling photographer“. In the post, I discuss using the software FotoBiz for invoicing and pricing jobs. Check out that post if you need help with pricing and invoicing.