When photography is your business then you need to be tracking your mileage and vehicle expenses for tax purposes.

Why is mileage log important to me?

The IRS also requires you to keep detailed records. IRS Publication 463 Travel, Entertainment, Gift, and Car Expenses Table 5-1 “How To Prove Certain Business Expenses” states

“For car expenses, the cost of the car and any improvements, the date you started using it for business, the mileage for each business use, and the total miles for the year.”

For the past 30+ years I have tracked all my mileage and expenses by hand.

This week I just started trying a new system. If you have a smartphone this is really cool and easy way to track your mileage. I recommend you checking out TripLog for use with your Android Device or iPhone.

TipLog Highlights

- The most popular GPS mileage tracking app with over 300,000 downloads

- The only app that AUTO STARTS when connected to power or Bluetooth devices

- The only mileage tracking app that reads a vehicle’s odometer from OBD-II devices

- Sync and merge data to TripLog Web from multiple devices with Fleet Management

- The most comprehensive reports compliant to IRS TAX returns

|

| Click on image to see larger |

Besides downloading the APP I also bought the OBD-II device recommended by TripLog.

BAFX Bluetooth OBD2 scan tool (recommended) |

This cost $23.99 from Amazon. Had it the following day after I ordered it. The thing it does is syne the odometer. Side benefit it also has capability to tell you about your car. Read & Clear diagnostic trouble codes for the check engine light, both generic & manufacturer specific codes. Get REAL-TIME sensor information right on your phone! EOT, RPM, Speed, DPF Temp, Balance Rates, O2 Readings & so MUCH more! Even pre-test for emissions testing! Get you 1/8, 1/4, 1/2 & 1 Mile times right on your phone!

You can have the APP show up three different ways on your phone. Just start button, larger 2×2 with Odometer showing, start button, type of mileage and the click to the APP.

I like the one on the bottom in the photo above. Instead of Mileage Today I have it set to show my Odometer.

It is very customizable for your taste.

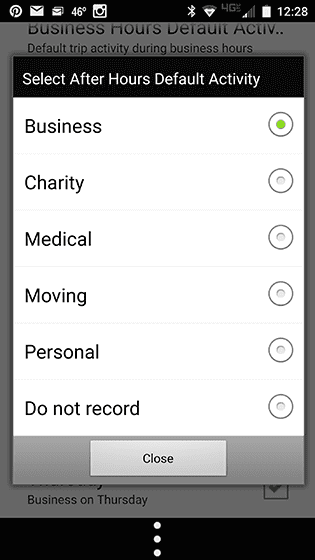

You can set a default category for your trips. You can also assign a category to a specific place. So if you go to the bank on a regular basis for business then you can set that as a default for that location. If you go to your doctor you can then assign that to be tracked as medical.

Really is a time saver when you are doing your taxes later.

Generate HTML and CSV (spreadsheet) reports from the app

Open TripLog > Reports tab > Email Reports button > follow the instructions > send reports through email.

You can open both CSV and HTML files in Excel.

This is the web interface. You can do a lot more with a paid subscription of $10, $25 or $45 a year. The $25 a year is what I will be doing. You can use all the functions for 30 days for free before choosing a plan.

You can generate reports right from your phone and email them.

Summary

While you will spend sometime to set this up and understand all that it can do for you, once you have done this then the APP can do much of the tracking automatically. I am just tapping start and stop for trips at the moment.

I am getting used to the APP and how it works with my Toyota Sienna this December before I totally switch over to this to track all my expenses with the vehicle for TAX year 2016.